Why personalisation matters in financial marketing – and how to get it right

23 Jun 2025 | by Katie Harvard

6 min read

From inbox overload to individual relevance

The constant stream of marketing communications means our inboxes are constantly inundated with emails, ads, and app notifications. From school bulletins to the latest takeaway offers, marketers across every sector are competing for attention.

As a result, personalisation has become the difference between being ignored and driving engagement. And nowhere is this more critical — or more complex — than in the financial services sector.

There are few things more personal than our finances. Personalising a holiday deal or a pizza offer is great, but personalising a mortgage reminder, savings suggestion, or insurance quote is another level entirely.

When done well, personalisation in financial marketing builds trust, improves engagement, and supports better financial decisions. Done badly, and you risk irrelevance at best — or reputational damage at worst.

So how can financial marketers put their money where their mouth is and cash in on timely, personalised marketing campaigns? Let’s take a closer look.

What is personalisation, and why does it matter?

At its core, personalisation is about tailoring content, timing, and channels to the needs, preferences, and behaviours of individual customers. It moves marketing from generic to specific, from scattergun to strategic. Why? Because customers don’t just want to be seen as data points. They want to be understood.

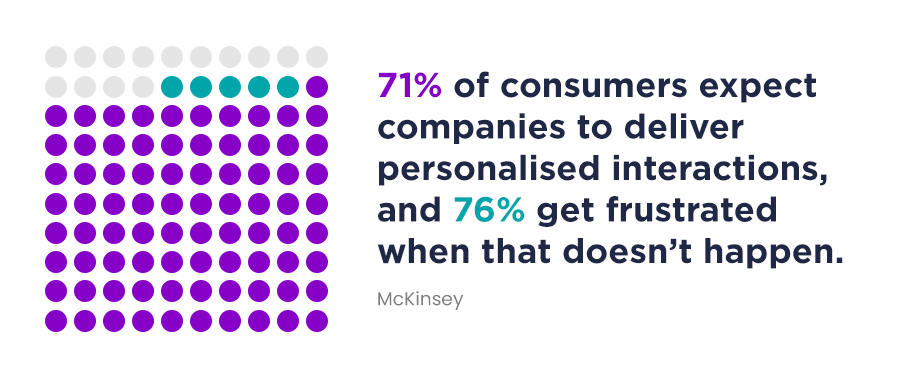

Most importantly, personalisation works. According to McKinsey, 71% of consumers expect companies to deliver personalised interactions, and 76% get frustrated when that doesn’t happen. This explains why 89% of business leaders say that personalisation is key to business success.

However, while 85% of companies believe they provide personalised experiences, only 60% of customers agree. In fact, Salesforce reports that 61% of customers believe they're often treated like numbers rather than individuals.

For financial marketers, personalisation means moving beyond “Dear [First Name]” to offering relevant, timely, and useful interactions. Whether it’s a well-timed reminder, a product that meets their current life stage, or a simple nudge based on past behaviour, the result is greater cut-through, improved conversion, and higher lifetime value.

Why personalisation is especially important in financial services

Finance is a deeply personal and sensitive topic. Few things in life are more emotionally charged than money — and few sectors require more trust.

Consumers want reassurance that the brands handling their finances understand who they are, what they need, and what they’re going through. And increasingly, they expect the same level of seamless, personalised service they get from their favourite retailers and streaming platforms.

But there are unique challenges in financial services:

🧩 Complex product sets

Financial products aren’t always easy to understand. Mortgages, pensions, ISAs, loans, credit cards, insurance — each comes with its own rules, terminology, conditions, and suitability requirements. Customers may not even know which product fits their needs, let alone how to compare options.

A generic campaign won’t cut it. If you send a blanket email about fixed-rate mortgages to a retired customer who owns their home outright, you’re not just wasting an opportunity — you’re damaging your credibility. Personalisation ensures the right people see the right products, in a way that makes sense to them.

⚖️ Heavily regulated environment

The financial sector operates under strict regulatory scrutiny. Marketing communications must be fair, clear, and not misleading. That means no exaggeration, no ambiguity, and no promoting products to people they’re unsuitable for.

Personalisation here isn’t just about relevance — it’s about compliance. The more you know about your customer, the better positioned you are to offer only those products that are appropriate for their situation, within regulatory guidelines.

⏳ Longer buying cycles

Unlike choosing a new pair of trainers or ordering a takeaway, financial decisions aren’t made on a whim. Customers often take weeks, months, or even years to choose a pension plan or switch banks. That means marketers must nurture relationships over time, with well-timed nudges that align with customer intent.

It’s a long game. Sending the right message at the wrong time can ruin all your hard work so far. Personalisation lets you time your communications to match the customer’s stage in their journey.

🎲 High stakes, low tolerance for error

In financial services, a poorly timed or tone-deaf message can have real consequences. A clumsy “Need a loan?” email sent right after a customer misses a payment could feel intrusive or insensitive. A generic offer on premium investment products could overwhelm someone just starting their savings journey.

Consumers are trusting you with their money — and often, their future. Missteps aren’t just inconvenient; they’re reputationally risky. That’s why personalisation isn’t a gimmick. It’s an act of service, showing customers you understand their needs, respect their situation, and are ready to support them responsibly.

The technical foundations of personalisation

To achieve the high level of relevance that customers expect, marketers need more than just good intentions. Personalisation at scale requires a robust data and technology foundation to collate and update customer information.

1. Single customer view (SCV)

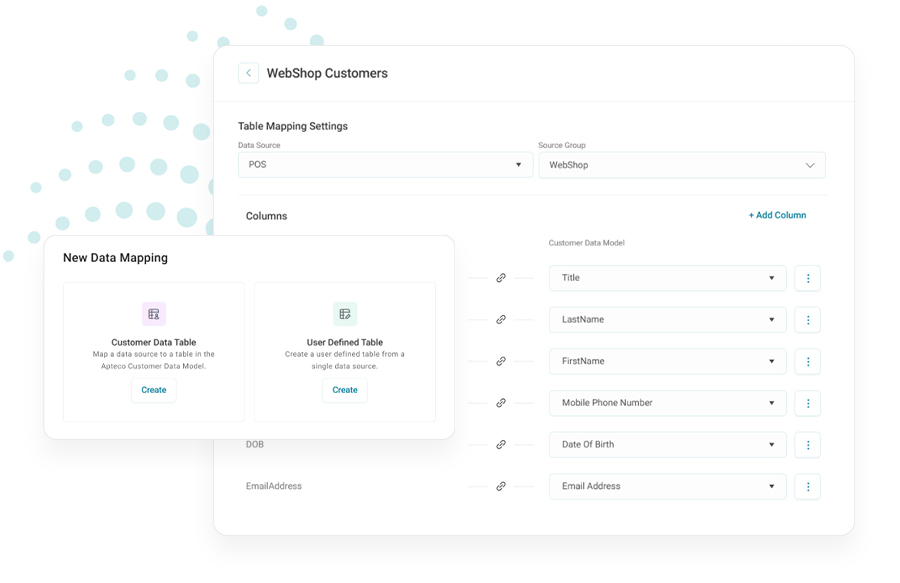

An SCV brings together all your customer data — from CRM systems, transactions, digital behaviour, and more — into a single, unified profile.

No more duplicate records or fragmented views. Just one clear picture of each customer’s journey, preferences, and interactions.

2. Behavioural and transactional data

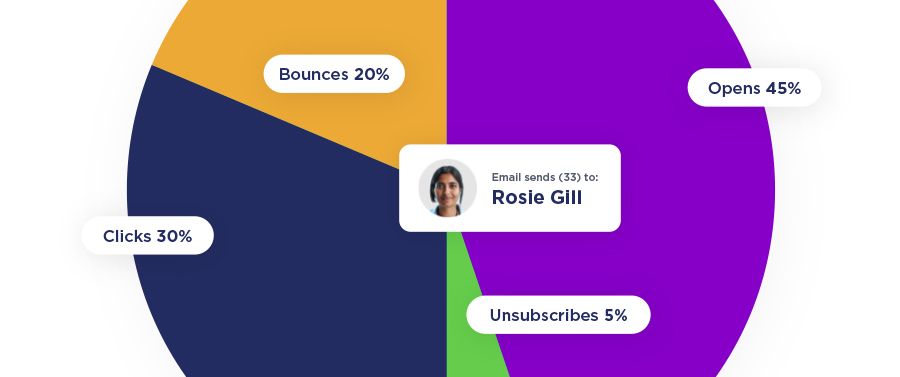

With the right marketing tools you can better understand each customer’s behaviour. That enables you to see which products they hold, how they interact with your channels, whether they’re a hot prospect or likely to churn, and which messages they’ve engaged with. Understanding these behaviours is key to targeting the right message at the right time.

3. Contextual awareness

Life changes quickly. A customer who was a student yesterday might be a full-time professional today. Contextual data — like life stage, location, income bracket, or even recent browsing history — helps keep your messaging relevant.

4. Analytics and automation

To make personalisation scalable, marketers need tools that can:

- Score and segment audiences dynamically

- Trigger campaigns based on real-time behaviours

- Test and optimise content automatically

Marketing automation powered by intelligence gives marketers this capability on demand.

How Apteco helps you personalise with confidence

This is exactly where Apteco comes in.

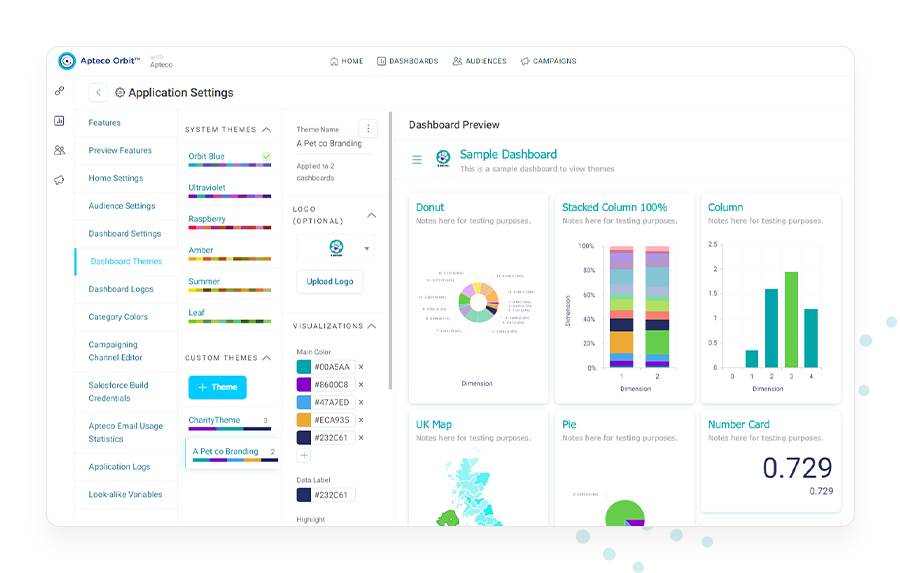

Apteco Orbit is designed to help financial marketers unlock the full value of their data and deliver personalised, compliant, and high-performing campaigns, without the complexity.

Here’s how we make it happen:

🔗 Unified customer profiles

Apteco integrates data from across your systems to create a single, reliable view of every customer. No more data silos. Just complete insight.

🎯 Smart segmentation and targeting

Use powerful filtering, modelling and behavioural analysis to identify micro-audiences based on demographics, financial behaviour, engagement level and more.

🚀 Triggered, automated campaigns

Set up real-time campaigns that respond instantly to customer actions, from browsing a product page to updating contact details.

🔄️ Channel flexibility

Whether it’s email, SMS, push notifications, or direct mail, Apteco helps you deliver messages through the channels your customers actually use.

💡 Compliant by design

We know compliance is non-negotiable. Apteco’s tools are built to support responsible data use, with full control, auditability, and rules-based logic to ensure messages are always appropriate.

✨Insight to action – all in one place

From analytics dashboards to campaign deployment, Apteco gives you the full end-to-end capability to understand your customers and act on that understanding — fast.

Personalisation isn’t optional – it’s expected

Financial marketers want to personalise their marketing campaigns, and they want to do it effectively, ethically, and at scale.

The good news is you already have the raw material: your data.

With the right technology, you can bring that data to life, creating personalised experiences that drive results and build trust.

Apteco gives you the power to do exactly that. By turning insight into action, we help financial marketers create smarter campaigns, stronger connections, and better outcomes for everyone.